Maximizing ROI with Mid-Term Rentals: The Perfect Blend of Stability and Profit

- Sabhya Katia

- Jan 21

- 4 min read

As real estate investing evolves, the mid-term rental strategy has emerged as an exciting opportunity for investors seeking a balance between steady cash flow and reduced operational intensity. Mid-term rentals cater to tenants who need housing for one to six months, such as traveling professionals, remote workers, or families in transition. This strategy has become increasingly appealing in today’s market due to trends like rising remote work opportunities and growing challenges in housing affordability, which drive demand for flexible yet stable rental options. This approach fills the gap between traditional long-term rentals and high-turnover short-term rentals.

In this blog, we’ll explore the mid-term rental strategy with number-based examples and compare it to long-term and short-term rental approaches to highlight its potential.

What Are Mid-Term Rentals?

Mid-term rentals involve leasing furnished properties to tenants for extended stays, typically longer than 30 days but less than a year. These rentals attract:

Traveling nurses and healthcare professionals.

Corporate employees on temporary assignments.

Digital nomads seeking flexible housing.

Families relocating or renovating their homes.

This strategy offers a mix of stability and higher income potential compared to long-term rentals while avoiding the operational intensity of short-term rentals.

The Math Behind Mid-Term Rentals

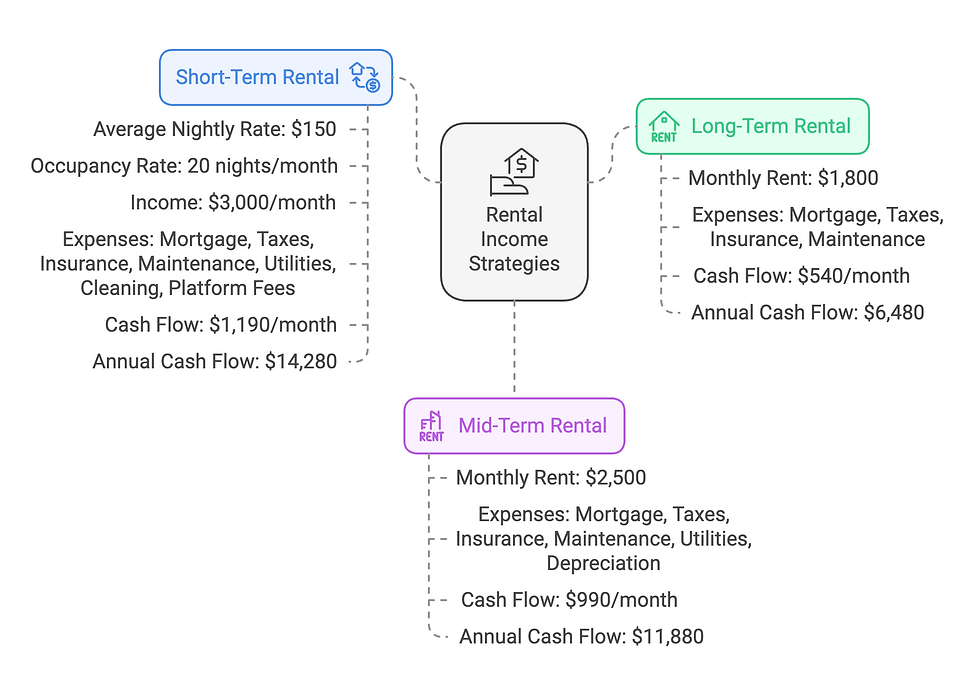

Let’s break down the potential returns of mid-term rentals compared to long-term and short-term strategies using a common property example:

Property Type: 3-bedroom house.

Purchase Price: $200,000.

Down Payment: 20% ($40,000).

Interest Rate: 5% on the remaining loan.

1. Long-Term Rental Example:

Monthly Rent: $1,800.

Expenses:

Mortgage: $860

Taxes & Insurance: $300

Maintenance: $100

Cash Flow: $540/month.

2. Short-Term Rental Example:

Average Nightly Rate: $150/night.

Occupancy Rate: 20 nights/month.

Monthly Income: $3,000.

Expenses:

Mortgage: $860

Taxes & Insurance: $300

Maintenance: $100

Utilities: $200

Cleaning Fees: $200

Platform Fees: $150

Cash Flow: $1,190/month.

3. Mid-Term Rental Example:

Monthly Rent: $2,500 (targeting traveling professionals).

Expenses:

Mortgage: $860

Taxes & Insurance: $300

Maintenance: $100

Utilities: $200

Furnishing Depreciation: $50

Cash Flow: $990/month.

Why Choose Mid-Term Rentals?

1. Higher Rental Income:

Mid-term rentals offer significantly higher income potential than long-term rentals, albeit lower than short-term rentals. For example:

Mid-term rental earns $990/month.

Long-term rental earns $540/month.

Short-term rental earns $1,190/month.

2. Reduced Turnover:

While short-term rentals require frequent tenant turnover and intensive management, mid-term rentals average 3–6 months per tenant, reducing vacancy costs and operational workload.

3. Stable Demand:

Mid-term rentals thrive in markets near:

Hospitals (traveling nurses).

Corporate hubs (temporary employees).

Universities (visiting scholars).

Setting Up a Mid-Term Rental

1. Furnishing the Property:

Unlike long-term rentals, mid-term rentals must be fully furnished and move-in ready. Focus on durability and comfort:

Furniture Cost: $5,000–$8,000 for basic furnishings.

ROI: A one-time furnishing investment can pay off within the first year.

2. Utilities and Internet:

Provide utilities (electricity, water, gas) and high-speed internet to meet tenant expectations.

Monthly Utility Cost: $200–$300.

3. Marketing:

List your property on platforms like Furnished Finder or Airbnb (for stays over 30 days). Highlight amenities such as:

Proximity to hospitals or corporate offices.

Work-from-home features (desk, chair, fast Wi-Fi).

Choosing the Right Neighborhood and Amenities

1. Selecting the Right Neighborhood (A, B, C):

The location of your property significantly influences its profitability. Match your property’s offerings to the neighborhood class:

A-Class Neighborhoods: High-end areas with affluent tenants. Mid-term rentals here should include premium amenities such as luxury bedding, high-speed internet, and modern appliances.

Example: Rent at $3,500/month compared to $2,500 in a B-class area due to demand for upscale features.

B-Class Neighborhoods: Middle-income areas with a mix of professionals and families. Focus on modern but cost-effective furnishings and amenities like reliable Wi-Fi and comfortable furniture.

Example: Offering a mid-term rental at $2,500/month for traveling nurses or corporate tenants.

C-Class Neighborhoods: Affordable areas where tenants prioritize value. Focus on basic but functional offerings like clean, durable furnishings and a safe environment.

Example: Charge $1,800/month in a budget-conscious market.

2. Adding Desirable Amenities:

Amenities can set your property apart and attract tenants willing to pay a premium. Consider:

Work-from-Home Setup: Desk, ergonomic chair, and fast internet.

Fully Stocked Kitchen: Quality cookware, utensils, and appliances.

Smart Home Features: Thermostats, security cameras, and keyless entry.

Comfort Upgrades: Premium mattresses, blackout curtains, and cozy living areas.

By tailoring renovations and amenities to the neighborhood’s demographics, you maximize your property’s appeal and ROI.

How Technology Can Help:

Platforms like PropIQ provide insights into neighborhood trends and tenant preferences, enabling you to identify which amenities or upgrades offer the highest ROI for your mid-term rental.

Challenges of Mid-Term Rentals

1. Higher Initial Costs:

Furnishing and utility expenses are higher than long-term rentals.

Solution: Consider these as an investment that pays off with higher rental income.

2. Market Limitations:

Demand for mid-term rentals may vary by location.

Solution: Target specific tenant groups, such as healthcare workers or corporate travelers, based on the local market.

3. Tenant Screening:

Shorter leases may attract less committed tenants.

Solution: Implement thorough screening processes to ensure reliability.

Final Thoughts

The mid-term rental strategy offers a unique blend of stability and profitability. By understanding your target market, furnishing your property appropriately, and setting competitive prices, you can achieve higher income than long-term rentals while reducing the operational burden of short-term rentals. Whether you’re a seasoned investor or exploring new opportunities, mid-term rentals could be your next profitable venture.

Kommentare